|

Current Positioning / Changes |

• BTS is positioned defensively in cash after a High Yield ‘sell’ was issued on 8/31/2022. • Proprietary models gave new sells shortly after the Federal Reserve’s pivot back to hawkish commentary at the Jackson Hole Conference. |

|

|

Risks & Opportunities |

• Performance has slightly underperformed the Bloomberg Aggregate Bond Index and the ICE BofA High Yield Index due to increased volatility in liquidity instruments. Bonds have seen unprecedented negative returns. • Markets are weighing the probabilities of a ‘soft-landing’ and a recession. • BTS believes a medium to severe recession is the most likely scenario due to the Fed’s need to control inflation by weakening a strong labor market and turning consumer and company behavior away from easy credit and free money. |

|

|

BTS Managed Income |

||

|

Current Positioning / Changes |

• The portfolio is underweighted on interest rate sensitive securities, given the Fed’s need to increase the Federal Funds Rate to combat inflation. • Higher quality, senior debt was overweighted in default risk allocations. There was a small exposure into high quality, income producing equities. |

|

|

Risks & Opportunities |

• Default risk and interest rate sensitive securities are both exposed to the risks of higher long-term inflation and higher interest rates, but the risk is well-managed by diversifying into higher quality credit and income producing securities that are resilient to rate hikes and recessionary environments. |

|

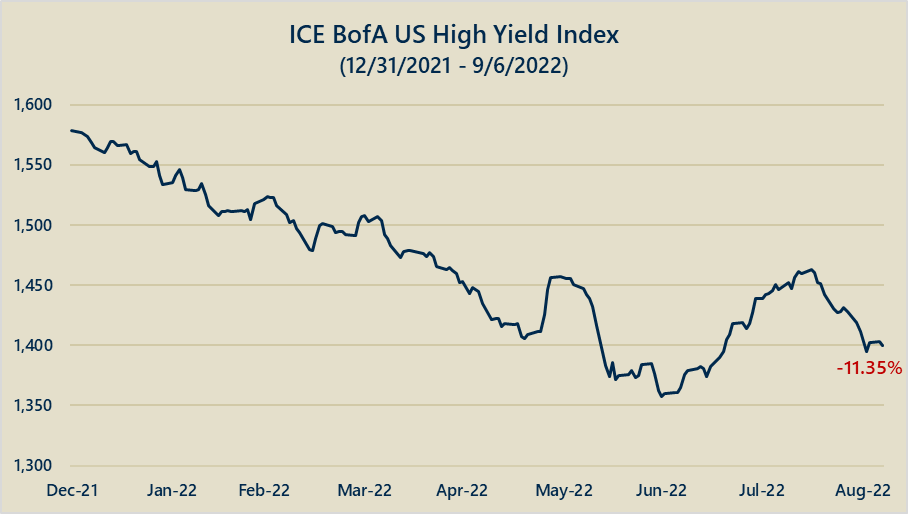

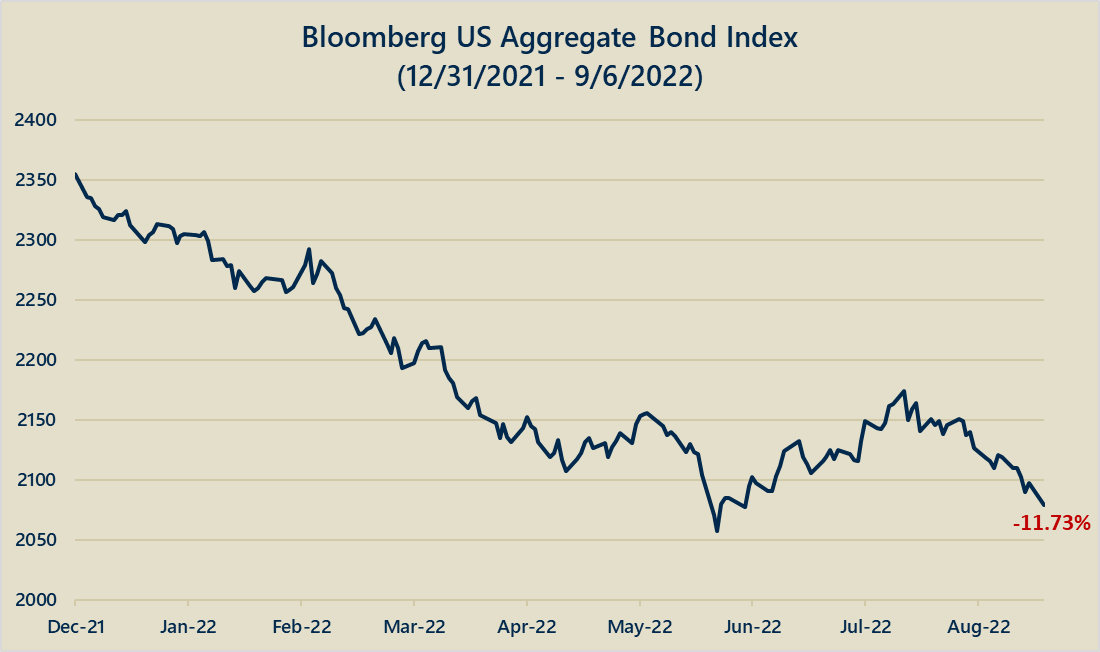

Our proprietary models have us positioned defensively, which is consistent with our belief that a ‘wait and see’ strategy is prudent until more information is available regarding how interest rate increases will affect inflation, the economy, and the jobs market. Price strength off the June lows was constructive and signaled that the inflationary and economic concerns were going to resolve themselves faster than the market expected, thus BTS positioned into risk in July. We saw a percent gain off the low in the ICE BofA High Yield Index that was indicative of a high probability of price follow-through that would create a lasting uptrend. However, the Fed’s comments at its Jackson Hole Conference derailed the price strength and BTS exited to preserve capital, as proprietary models gave clear sell signals.

Price Declines

Source: Bloomberg

Source: Bloomberg

The ICE BofA US High Yield Index and the Bloomberg Aggregate Bond Index are now both down over 11% YTD as of 9/6/2022, with BTS performance slightly underperforming due to the increased volatility in liquidity instruments. The recent price declines and the Fed’s position as an inflation fighter have increased the probability that the market makes new lows below the June price support levels.

What the Fed Can and Cannot Control

Given the factors that the Fed cannot control, such as global supply chain pressures from ongoing COVID-19 fallout, a world-wide energy crisis due to the Russia-Ukraine war, and other inflationary pressures from spending bills like Biden’s infrastructure and student loan forgiveness measures, the Fed’s only choice is to increase interest rates in order to affect corporate and consumer behavior.

BTS’ view is that the Fed will have to continue to increase interest rates further and in a more profound manner that the market currently expects in order to contain inflation. If this occurs, it will inevitably slow a cycle of easy credit and cause companies to cut costs and increase layoffs, which will cool a labor market that has been relatively strong. Given August’s strong labor report and the consensus that the Economy is not yet in a recession, the Fed will have even more rationale to increase rates by 75-100bp at the next FOMC meeting towards the end of September.

Changing Corporate and Consumer Behavior

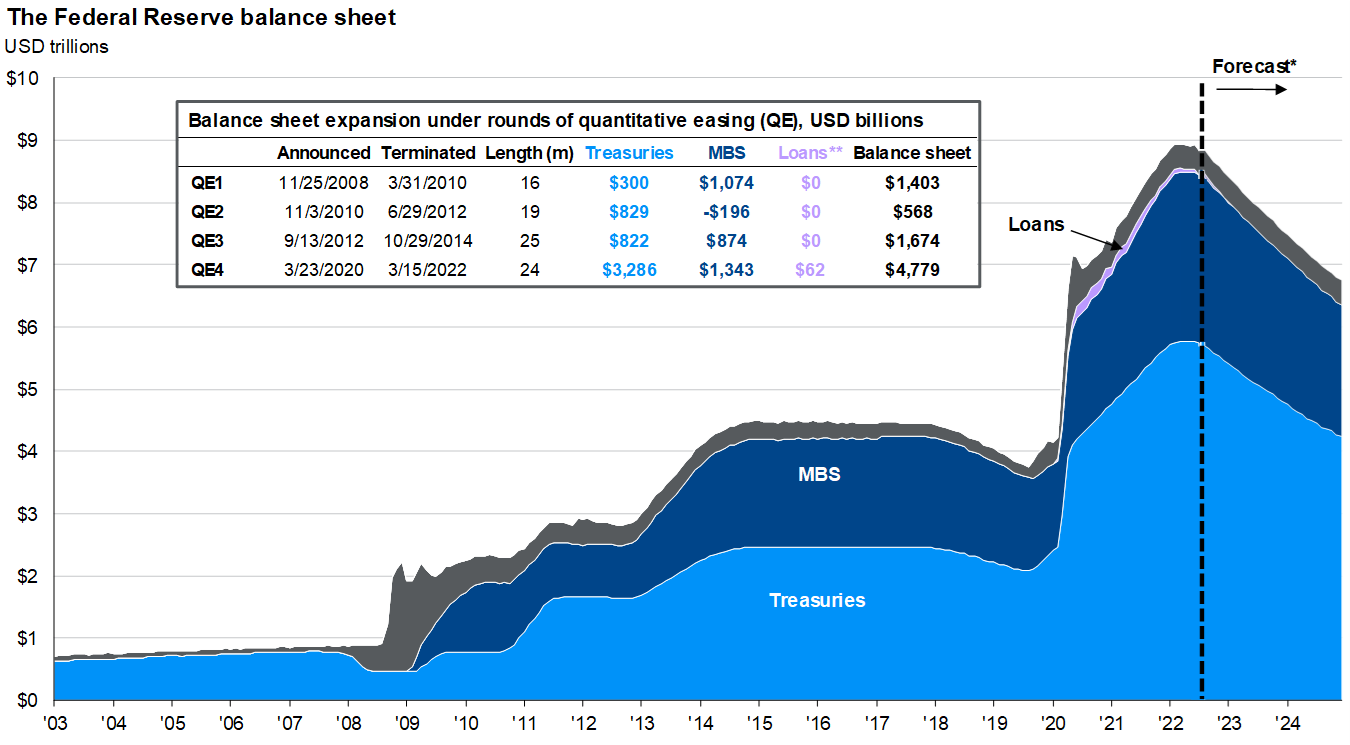

Coming out of the COVID-19 Recession, the Fed severely overshot its quantitative easing measures, which likely contributed to current inflationary pressures, which have been exasperated by COVID-19 fallout and geopolitical issues.

Source: J.P. Morgan Guide to the Markets

A continued unwinding of the Fed’s balance sheet in line with forecasts and Fed statements aims to reduce the money supply in the economy, which should decrease prices, as fewer dollars are chasing the same number of goods.

Interest rate increases will increase the cost to borrow and to carry debt, which negatively affects corporations that rely on financing. Companies with weak balance sheets will then have to cut costs and lay off staff as the cost of capital increases, which will increase unemployment and decrease demand as less people have incomes to spend with confidence. Trend levels still indicate that there are more job openings than job hirings, but we believe that as the Fed continues to increase interest rates, this dynamic will shift to reduce both openings and hirings.

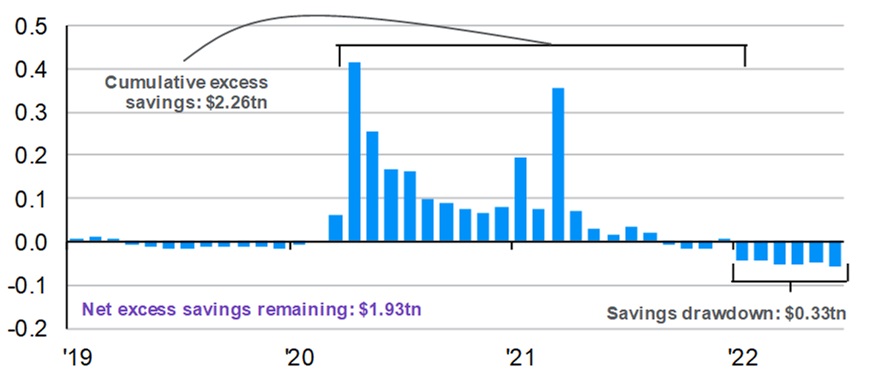

Excess personal savings relative to pre-pandemic trend

Disposable personal income less consumer outlays, minus pre-pandemic trend growth***, $ trillions, monthly

Source: J.P. Morgan Guide to the Markets

Consumer behavior is also a problem that the Fed is trying to address with its policy. The U.S. government’s COVID-19 relief aid and higher unemployment benefits increased consumer savings, but we are beginning to see outflows of savings that are driving price increases from excess demand. To combat this inflationary pressure, the Fed most likely has to increase the unemployment rate in order to decrease incomes and prevent overly-exuberant spending by consumers from current savings and the reassurance of future income.

The Fed tried to convince market participants that inflation would be ‘transitory’ back in 2021 but the new ‘soft-landing’ language that replaced its ‘transitory’ message may be just as unlikely to hold true. The risk still remains that a severe recession, and prolonged bear market, will keep risk assets at depressed price levels. The Fed is in a position where it needs to tighten and increase rates to affect what it can, such as corporate and consumer behavior.

During heightened risk of recession, markets experience increased levels of volatility, where Tactical Asset Allocation strategies historically outperform the returns seen from the S&P 500 or comparable stock market index. Managing the recession risk into 2023 is crucial to eliminate the possibility of a 30-45% decline in a portfolio, which is extremely difficult to recover from.

The next bull market may be years away if the U.S. economy becomes entrenched in a severe recession. We believe navigating between risk, cash, treasuries, and other uncorrelated strategies during widespread risk asset declines is crucial to attain the desired goals of an uncorrelated return stream that can mitigate capital losses going into a recession and that can participate in favorable opportunities coming out of a prolonged recession.

Disclosures

This commentary has been prepared for informational purposes only and should not be construed as an offer to sell or the solicitation to buy securities or adopt any investment strategy, nor shall this commentary constitute the rendering of personalized investment advice for compensation by BTS Asset Management, Inc. (hereinafter “BTS”). This commentary contains only partial analysis and, therefore, should not be construed as BTS’ general, complete, or most current assessment, projection or outlook with respect to the topics discussed herein. This commentary contains views and opinions which may not come to pass. To the extent this material constitutes an opinion, assumption, forecast or projection, recipients should not construe it as a substitute for the exercise of independent judgment. This material has been prepared from information believed to be reliable, but BTS makes no representations as to its accuracy or reliability. The views and opinions expressed herein are subject to change without notice. Returns for specific BTS portfolios are available upon request.

It should not be assumed that investment decisions made in the future will be profitable or guard against losses, as no particular strategy can guarantee future results or entirely protect against loss of principal. There is no guarantee that the strategies discussed herein will succeed in all market conditions or are appropriate for every investor. Investing in BTS portfolios involves risk, including complete loss of principal. General portfolio risks are outlined in BTS’ Form ADV Part 2A and specific strategy brochures, which are available upon request. Clients and prospective clients should review these risks with their financial representative before deciding to invest in BTS portfolios.

The S&P 500 includes 500 leading companies in leading industries of the US economy and is a proxy for the total stock market.

The Lipper High Yield Index is an unmanaged index of the 30 largest high yield mutual funds based on total year-end net asset value. It assumes the reinvestment of dividends and capital gains, as well as management fees and expenses, but does not include any actual management fees or expenses associated with a fund.

Bloomberg Aggregate Bond Index - An index used by bond funds as a benchmark to measure their relative performance. The index includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The maturities of the bonds in the index are more than one year.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting.

ICE BofAML US High Yield tracks the performance of US dollar-denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one-year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Also, qualifying securities must have risk exposure to countries that are members of the FX-G10, Western Europe, or territories of the US and Western Europe. The FX-G10 includes all Euro members, the US, Japan, the UK, Canada, Australia, New Zealand, Switzerland, Norway, and Sweden.

Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market of consumer goods and services.

*Index returns are for illustrative purposes only and should not be construed as BTS model performance or performance achieved by any BTS client. More specifically, any reference to index returns during isolated or defined periods in time is for reference only and is not meant to imply index returns are indicative of actual returns achieved in client portfolios. Investors cannot invest directly in an index, and index returns do not reflect management fees, custodial fees or brokerage commissions, which vary depending upon the custodian chosen.

Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market of consumer goods and services.

Source: Morningstar (for index returns)

BTS Asset Management is affiliated with BTS Securities Corporation, member FINRA/SIPC. Securities are offered through BTS Securities Corporation and other FINRA member firms. Advisory services are offered through BTS Asset Management, Inc.

BTS Asset Management, Inc. ("BTS") is an investment adviser registered with the SEC. BTS' website is limited to the dissemination of general information regarding BTS' investment advisory services. The information on this website is for general informational purposes only and should not be construed by any prospective or existing client of BTS as a solicitation to effect transactions in securities. In addition, the information on this website should not be construed by any prospective or existing client as personalized investment advice. BTS’ investment advice is given only within the context of its contractual agreements with each client. BTS' investment advice may only be rendered after the delivery of its Form ADV Part 2 and the execution of an agreement by the client or investor. BTS' Form ADV Part 2 describes BTS' business operations, services and fees and is available upon request. All information contained on this website is subject to change without notice. The information contained on this website may include forward looking statements which are based on BTS' current opinions, expectations and projections. BTS does not have any obligation to update or revise any forward looking statements. Actual results could differ materially from those anticipated in the forward looking statements. Past performance is no guarantee of future results.