Together with BTS co-portfolio manager Matthew Pasts, I had the honor of presenting at last week’s annual High Yield Bond Conference convened by the CFA Society of New York.

Event chair Martin Fridson, CFA, Chief Investment Officer, Lehmann Livian Fridson Advisors LLC, invited us to present on technical analysis of high yield bonds—a topic that Martin said hadn’t been previously covered in the 28 years the CFA Society of New York has held this event.

We were pleased to share perspectives drawn from BTS’ decades of experience applying a technical approach to trading in the high yield sector. For example, we talked about model development with the practitioners in attendance. As we shared at the event, we see the following four points as critical when developing a model to guide trading:

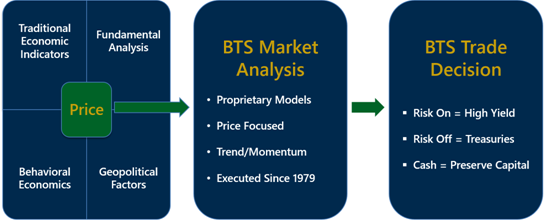

We also described the specific framework by which we analyze price data on our way to investment decisions. The following graphic reflects how price data, by its nature, incorporates a wide range of market influences. Our proprietary models focus on price because we’ve seen its impact for decades.

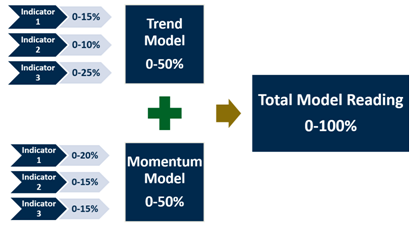

In the graphic shown above, one of the descriptors for “BTS Market Analysis” is “Trend/Momentum.” As we shared with high yield investment practitioners, our indicators are structured with a focus on these two categories (and are complemented by other inputs). At BTS we consider a combined Trend/Momentum reading of over 50% to indicate a positive intermediate-term trend, as described by the following graphic:

A final example pulled from our conversation with high yield practitioners highlights key points in our investment decision-making process—that is, how we apply the models themselves:

We were honored to participate in this outstanding event convened by the CFA Society of New York. If you would like to learn more about the BTS investment approach highlighted here, we invite you to be in touch.

It should not be assumed that investment decisions made in the future will be profitable or guard against losses, as no particular strategy can guarantee future results or entirely protect against loss of principal. There is no guarantee that the strategies discussed will succeed in all market conditions or are appropriate for every investor.

Most Recent

» Getting Our Risk On After Clearing A Higher Bar

Archive

2018

» Why Be Opportunistic During High-Yield Bond Market Volatility

» Stock Market’s Record Highs with Low Volatility – Implications for High Yield

» Medium-Term Trend for High Yield Remains Positive

» BTS Indicators Turned Positive on High Yield Bonds—Though 3% Level of 10-Year Treasuries Brings Risks

» High Yield Bonds Trading More in Line With S&P 500 Market Action

» Playing Defense-Trading Opportunity May Arise as Trends Stabilize

» Clearer Intermediate-Term Trend Signals About High Yield Bond Market

2017

» High Yield Market Sentiment Lackluster

» On BTS’ Recent Shift to a Defensive Portfolio Allocation

BTS Asset Management, Inc. ("BTS") is an investment adviser registered with the SEC. BTS' website is limited to the dissemination of general information regarding BTS' investment advisory services. The information on this website is for general informational purposes only and should not be construed by any prospective or existing client of BTS as a solicitation to effect transactions in securities. In addition, the information on this website should not be construed by any prospective or existing client as personalized investment advice. BTS’ investment advice is given only within the context of its contractual agreements with each client. BTS' investment advice may only be rendered after the delivery of its Form ADV Part 2 and the execution of an agreement by the client or investor. BTS' Form ADV Part 2 describes BTS' business operations, services and fees and is available upon request. All information contained on this website is subject to change without notice. The information contained on this website may include forward looking statements which are based on BTS' current opinions, expectations and projections. BTS does not have any obligation to update or revise any forward looking statements. Actual results could differ materially from those anticipated in the forward looking statements. Past performance is no guarantee of future results.